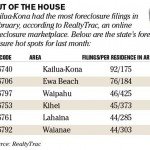

Well, there is good news and bad news regarding foreclosures in the state of Hawaii. The good news; it seems that state foreclosures are down by 2% from last month, which is great! The bad news; it seems the only reason foreclosures are down is because lenders are having a hard time processing cases at a quick enough pace.I for one choose to look on the bright side. A drop in foreclosures is a drop in foreclosures. Still though, it is cautious optimism, as I do indeed find it hard to believe that lenders are able to keep up with the current amount of properties being foreclosed on.There were 953 Hawaii foreclosure actions in reported in February. This is compared with the 972 foreclosure actions reported in the same month last year. These numbers are according the real estate website RealtyTrac. The website also suggests that February was the third consecutive month of lower year-over-year foreclosure filings in the state, and the number of filings compares with a peak of 1,629 in August.Most foreclosure attorneys and housing advocates still have guarded optimism, as other nationwide stats suggest that Hawaii is still in the bottom ten in the nation in regards to foreclosures.

Well, there is good news and bad news regarding foreclosures in the state of Hawaii. The good news; it seems that state foreclosures are down by 2% from last month, which is great! The bad news; it seems the only reason foreclosures are down is because lenders are having a hard time processing cases at a quick enough pace.I for one choose to look on the bright side. A drop in foreclosures is a drop in foreclosures. Still though, it is cautious optimism, as I do indeed find it hard to believe that lenders are able to keep up with the current amount of properties being foreclosed on.There were 953 Hawaii foreclosure actions in reported in February. This is compared with the 972 foreclosure actions reported in the same month last year. These numbers are according the real estate website RealtyTrac. The website also suggests that February was the third consecutive month of lower year-over-year foreclosure filings in the state, and the number of filings compares with a peak of 1,629 in August.Most foreclosure attorneys and housing advocates still have guarded optimism, as other nationwide stats suggest that Hawaii is still in the bottom ten in the nation in regards to foreclosures.

Foreclosure Rates by StateWorst: Nevada – One foreclosure for every 119 households, or 9,553 foreclosure filings total.*When you are a state based on gambling that is what happens!Best: Vermont – One filing per 62,849 households, or just five foreclosure filings.*When nobody wants to live in your state there are really no foreclosures to report!Hawaii’s Rate: One filing per 541 households, which was 10th worst nationally. Hawaii has been at or close to the 10th worst spot for several months.The rest of the state foreclosures shape up like this:Big Island: Worst foreclosure rate at one filing per 270 households, or 299 filings in all.Maui County (Made up of Maui, Molokai and Lanai): One filing per 362 households, or 184 filings total.While it may seem bleak at first glance, you need to take into account a couple of facts. RealtyTrac doesn’t exclude commercial property from its count. This means that property such as hotels and popular vacation properties and rentals are all put into the final count. If you were to take these out, then the number would be considerably lower in relation to single-family homes and condos.The number of foreclosures may also be a bit skewed because RealtyTrac does count different types of filings during different months, which means that multiple filings on the same property may be listed.Either way, the outlook for home-buying right now is good. Interest rates are still low, and now is a great time to get a property under your belt.

Related Articles

- February Foreclosures hit three-year low (capitolhillblue.com)

- Foreclosure notices drop 14% to 36-month low (cbsnews.com)

- Foreclosures plunge 27% – biggest drop on record (money.cnn.com)

Leave a Reply